At the start of the COVID-19 pandemic, Tala established the COVID-19 Rebuild Fund to support customers providing essential services to their communities. Through the fund, we offered specialized 0% interes Community Support Loans to hundreds of entrepreneurs across Kenya providing food, healthcare, education, and related logistics.

In the two months since distributing the loans, we sought to better understand the impact of the Rebuild Fund and how these customers were adapting to a new normal. Here are some initial insights from a survey of recipients.

All experienced significant strain at the start of the pandemic. Many struggled to maintain inventory facing a lack of capital, disruptions in their supply chains, limited available items in supermarkets, mobility restrictions and curfews. 30% of respondents had to reduce the number of their employees before receiving their loan and 15% were forced to close down before the Rebuild Fund helped them reopen.

Businesses added new food and medicine, offered credit and more. A majority of entrepreneurs added delivery services and takeout options. Many now take orders on Whatsapp to minimize exposure to customers and offer credit to customers who can’t afford to pay. Despite their own hardships, 21% of recipients donated goods and services to frontline workers. Customers like Fridah in Narok, Kenya, who runs a hotel employing more than five people. Fridah uses her hotel to supply neighboring schools and health centers with lunch and volunteers her time to spread health information.

The Rebuild Fund helped entrepreneurs grow their income. 62% reported earning higher incomes after receiving their Community Support loan. The majority were also able to serve more customers. Zero businesses in Kenya closed after receiving a Community Support Loan.

Most used their loans to stock their businesses and pay employees. Owen, for example, runs a maize flour mill in Nzoia. He used his loan to increase his stock of maize to continue feeding his community. Many who had closed down used the fund to reopen.

Beyond finances, the Rebuild Fund had a positive emotional impact. A majority of respondents reported significantly lower levels of worry and increased feelings of positivity. The feeling of being supported grew. In these uncertain times, that feels as important as anything.

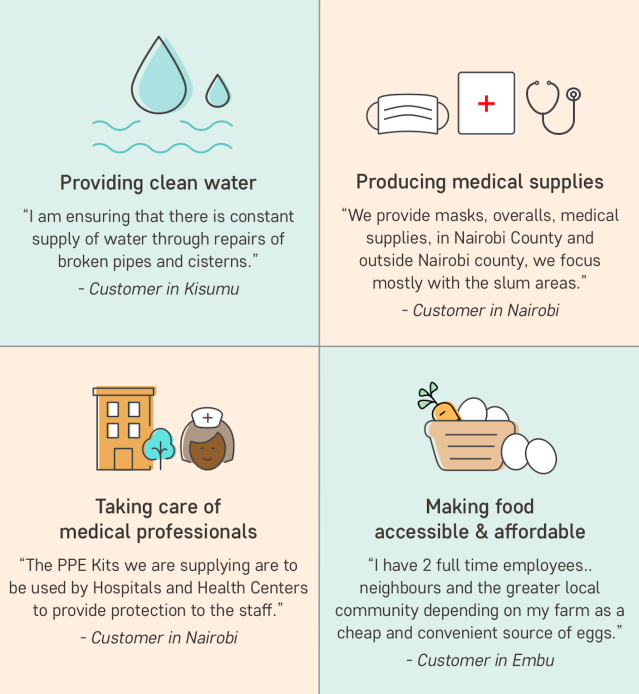

We are encouraged by the Rebuild Fund entrepreneurs’ remarkable resilience and inspired by the people of Kenya who are serving their communities during this difficult time. We’re proud to support some incredible customers through the Tala Rebuild Fund who are using their loans to create jobs and help thier communities cope with COVID-19 by: